Categories

Home Maintenance & ImprovementsPublished June 12, 2025

Navigating Flood Risk and Insurance in Louisiana: What 2025 Buyers Must Know

Buying a home in Louisiana means embracing the culture, charm, and beauty of our coastal communities.

But as you tour that beautiful raised cottage in Gentilly or a cozy shotgun in the Marigny, one reality looms large: flood risk. Nearly 80% of listings in New Orleans carry significant long-term flood exposure. Understanding this risk and how to navigate insurance is critical to making a smart, lasting investment.

Why Flood Risk Matters for Louisiana Buyers

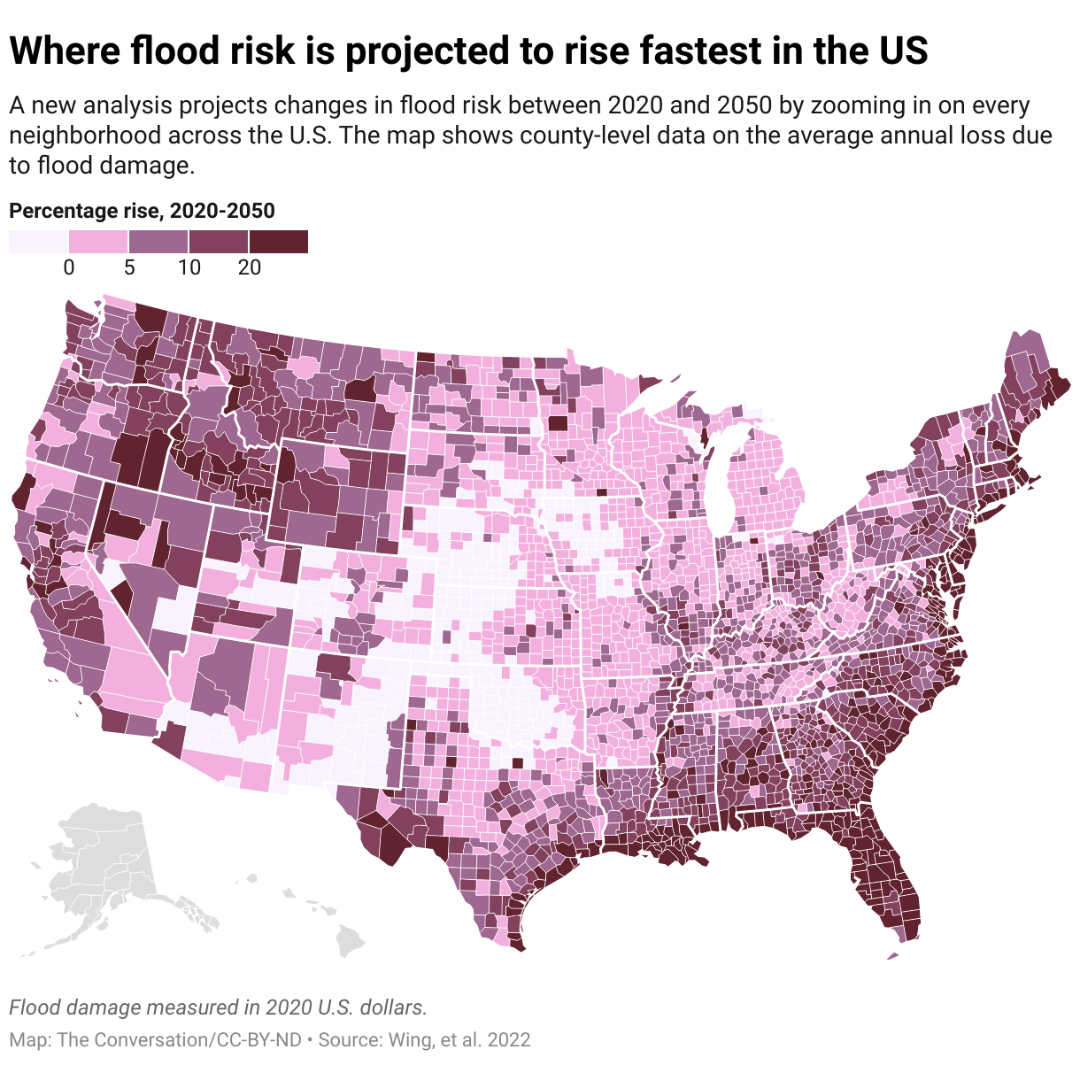

Louisiana's geography makes it especially vulnerable. Rising sea levels, heavy rainfall, aging levees, and land subsidence all contribute to increased flood exposure. FEMA flood zone maps (FIRM maps), Zillow climate risk scores, and LSU's flood mapping portal offer buyers crucial insights into a property's flood potential.

As of 2025, several parishes, including Allen Parish, are undergoing map updates that may change flood zone classifications. Buyers must stay informed as updated FEMA maps could shift insurance requirements overnight.

Flood Insurance Basics

Flood insurance is non-negotiable for homes in high-risk zones. Most buyers rely on the National Flood Insurance Program (NFIP), which recently adopted Risk Rating 2.0. This updated system has caused significant shifts in premium costs. While some older homes have seen decreases, many others face rising premiums.

-

Median flood insurance in Louisiana: ~$1,470/year

-

High-risk zones: Up to $4,752/year

Private flood insurance alternatives may offer competitive rates, but policies vary widely. Complicating matters, Louisiana's broader insurance crisis has led to nearly 70,000 NFIP policy drops between 2022-2024, putting pressure on affordability and lender requirements.

Smart Steps for Homebuyers

Step 1: Check Flood Zone Early

-

Use FEMA FIRM maps, Zillow climate scores, and LSU's flood portal.

Step 2: Budget for Insurance

-

Factor $800 to $1,500+ annually into your mortgage calculations.

Step 3: Understand Insurance Mandates

-

Flood insurance is required if financing in a Special Flood Hazard Area (SFHA).

Step 4: Invest in Mitigation

-

Elevation, flood vents, raised utilities, and smart landscaping can lower premiums.

Step 5: Shop Smart

-

Compare NFIP and private policies; consult trusted insurance brokers.

Step 6: Monitor Map Updates

-

Watch for changes in local flood zone maps that could alter your insurance needs.

The Williams Team Advantage

At The Williams Team, we lead with integrity and people-first thinking. We believe that informed buyers make the smartest, most confident decisions. Our deep understanding of local flood risks, insurance markets, and mitigation strategies ensures you're never navigating these waters alone. We partner with trusted insurance experts and mitigation professionals to guide you at every step.

-

FEMA Flood Map Service Center

https://msc.fema.gov/portal/home -

Zillow Climate Risk Data

https://www.zillow.com/research/data/ -

LSU Flood Maps & Coastal Studies

https://www.lsu.edu/research/coastal-research.php -

National Flood Insurance Program (NFIP) - FEMA

https://www.floodsmart.gov/ -

Risk Rating 2.0: Equity in Action - FEMA

https://www.fema.gov/flood-insurance/risk-rating -

Louisiana Department of Insurance - Flood Insurance Resources

https://www.ldi.la.gov/home